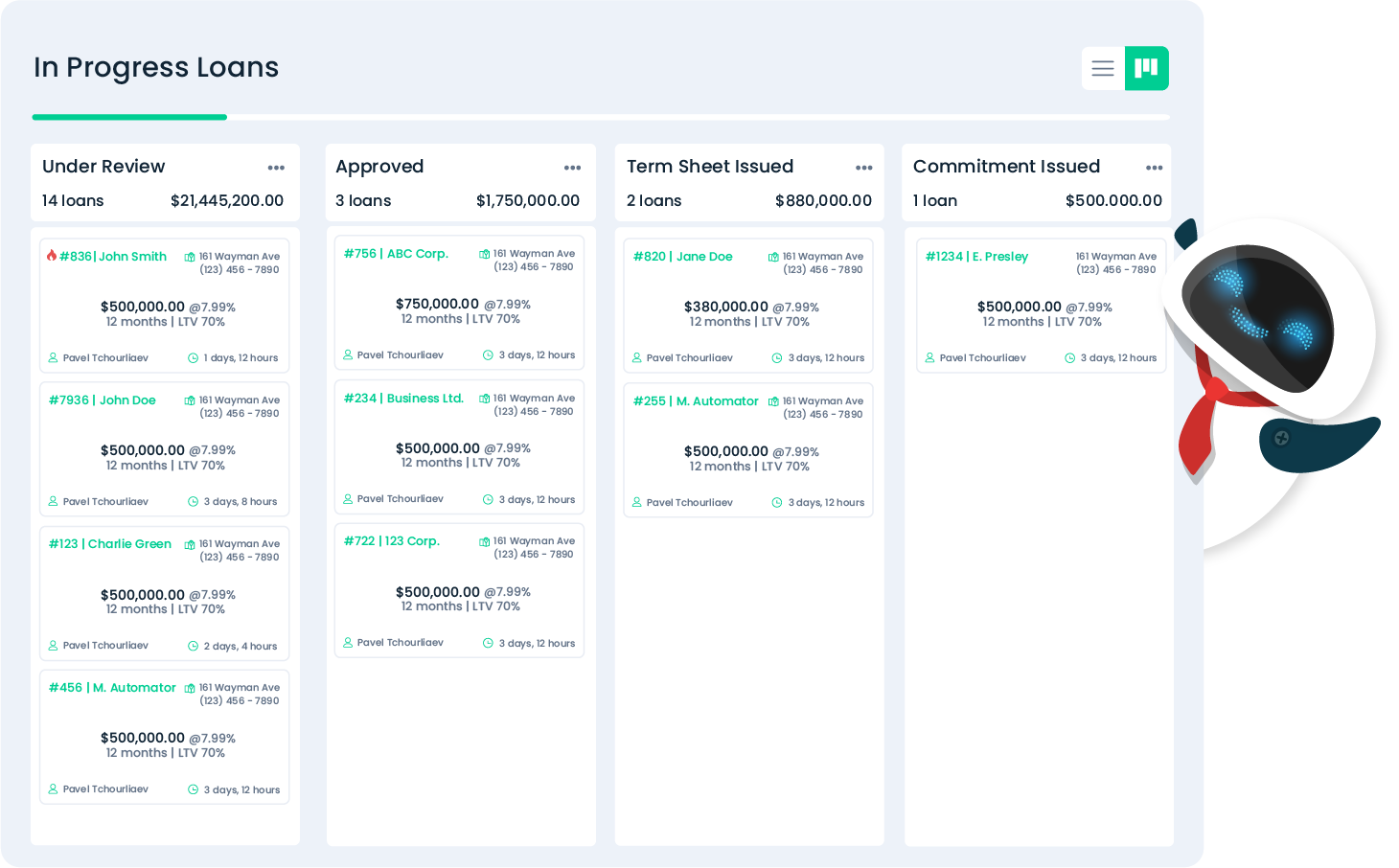

A complete loan origination suite is available to handle your lending processes. A borrower portal or a loan application form can be used by your borrowers to request new loans or pre-approvals. Loan Officers are automatically assigned and notified so that they can review and issue LOIs/Term Sheets quickly.

The Roles & Permissions module can control the access to and visibility of sensitive areas. The Communications module will not only keep all parties involved up-to-date with SMS notifications, but it can also send out pre-filled emails with attached system generated and uploaded documents.

Borrowers are able to use the Upload portal to add documents, photos, and videos for your review directly through the system.

Servicing loans in-house has never been easier. Automator’s powerful features not only allow you to keep track of loan ledgers but also automate collection processes, tax payments, reserve tracking, and much more. Every interest option is supported, including P&I and interest-only (standard, accrued, escalating, VRM, capitalized, Dutch on the full loan amount, or non-Dutch on individual draws, or even in-between with reduced interest on the standby funds). A multitude of reports is available to help manage your loans, including payment tracking reports, loan tapes, aged receivables, and more.

Investors can take advantage of a full or reduced rate, multi-tranche, or sub-investor options and will receive beautiful, organized, and easy-to-follow statements that are sent automatically on the morning of receiving their investor payments. This helps to establish a clear understanding of their portfolio and, more importantly, trust in your private lending process.

Numerous accounting and operational reports are available to give you a complete overview of your operations. At Mortgage Automator, we try to automate every process and report.

Whether it’s compliance or trust reinvestment reports, the system has you covered. Trust and Operating account ledgers allow you to dive deep and understand every number.

Focus on Growth

Why our customers ❤️ Mortgage Automator

Software designed and tailored for private lenders.

Mortgage Automator’s user interface is highly intuitive, making it easy for teams to quickly adopt the software. The tech support is prompt and efficient, answering any questions swiftly. The API supports extensive custom development, while the custom forms and workflows ensure that Mortgage Automator is the top platform in the private lending space.

Best product on the market

The team behind Mortgage Automator is the best. They are super responsive to all the customers needs. The software is super easy to learn and use and has a wide range of integrations and capabilities.

As seen on

Join the Industry Leaders

Top performers are switching to Mortgage Automator to power their entire private lending business and generate all their documents in minutes. It’s time to get ahead of the curve, gain a competitive advantage, and deliver exceptional value to your brokers, lawyers and investors!

375 + happy clients including:

Award Winning Software

Integrations & Partnerships